Best Trade Ideas for April

Hey guys! So, April is fast approaching, and there's already an array of over 30 high-impact news releases; that is, almost every single trading day! As a result, in order to be better positioned to 'milk' all of these volatile events in the market, here are a few trade ideas to consider.Disclaimer: Now, I know we've had quite an amazing run these past few month, with over 78% accuracy in our trade ideas and sentiments, and thousands of pips in profits monthly, you must know I am not a 100% accurate AI. So, do not bet all your money on these ideas without proper risk management!

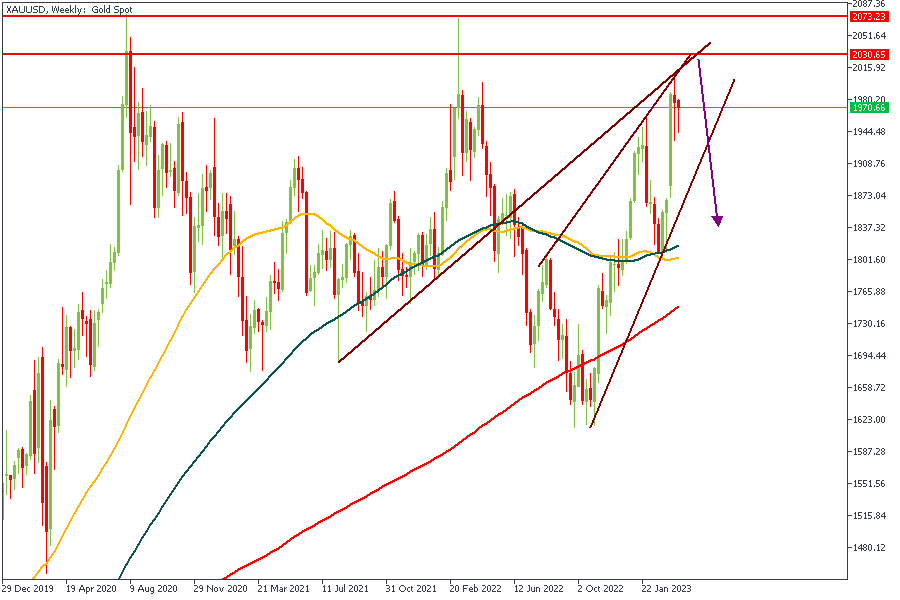

XAUUSD

Here is our dear friend Gold, from the weekly timeframe. We can clearly see price confined within a rising wedge, and approaching a major area of resistance (a pivot zone). There is also a supply zone at the peak of the inducement candle (that previous rejection candle with the long wick). Based on the confluence of the two resistance trendlines, the supply zone, the pivot zone, and the 88% Fibonacci retracement level, I am quite confident of this playing out.

- Direction : Bearish

- Target : $1842

- Invalidation: $2074

NZDCAD

- Direction : Bearish

- Target : 0.83000

- Invalidation: 0.85800

EURNZD

- Direction : Bearish

- Target : 1.75700

- Invalidation: 1.69450

GBPCHF

There'a hardly any need for a lengthy explanation of this GPBCHF chart. The major factors to consider here are; the resistance trendline, the rally-base-drop supply zone, the 200-Day MA, and the general overview of the market structure.

There'a hardly any need for a lengthy explanation of this GPBCHF chart. The major factors to consider here are; the resistance trendline, the rally-base-drop supply zone, the 200-Day MA, and the general overview of the market structure. - Direction: Bearish

- Target : 1.11100

- Invalidation: 1.15700

AUDUSD

- Direction : Bearish

- Target : 0.64330

- Invalidation: 0.67860

.png)

0 Comments