CAD Strengthens as Crude Prices Rise, When Are Forex Markets Open?

If you're a forex trader, you may be wondering if the markets are open for trading. The answer is yes, the forex markets are open 24 hours a day, five days a week. However, it's important to stay informed on market trends and trading opportunities, especially as factors like crude oil prices can impact currency values.Fundamental

Understanding the relationship between crude prices and CAD strength.

The Canadian dollar (CAD) is often referred to as a commodity currency, as its value is closely tied to the price of commodities like crude oil. When crude prices rise, the demand for CAD increases, leading to a strengthening of the currency in the forex markets. This relationship is important for forex traders to understand, as fluctuations in crude prices can have a significant impact on CAD values and trading opportunities.When Are Forex Markets Open?

The Canadian dollar (CAD) has been weak since February, not only due to pressure on crude oil prices, but also due to the divergence of the Bank of Canada's (BoC) monetary policy in relation to other central banks, and especially with the Federal Reserve (Fed).These pressures could continue in the short term, triggering higher CAD selling.

At the last Bank of Canada monetary policy meeting on March 8, 2023, the interest rate remained unchanged at 4.5%, as expected by the market. Since the last rate increase in January 2023, the bank's governor indicated that they would stop the monetary tightening cycle pending economic figures that support the expectations in the latest Monetary Policy Report.

Meanwhile, the Fed continues its tightening cycle after the last meeting on March 22, in which it raised the rate by 25 points to stand at 5%, despite signs of a negative impact on the banking system.

However, this increase had a moderate impact on CAD selling, due to the risk environment in the US itself, which has influenced USD selling against all its counterparts.

The US economic data and the risk environment of the last few weeks as a result of the banking crisis have been the main drivers of prices in the markets, and this includes commodities such as crude oil, which is closely correlated with the CAD. , since it represents the main export product from Canada to the US.

While risk aversion sentiment prevailed, crude oil prices precipitated their decline. But, since the banking authorities intervened through emergency credit lines extended to troubled banks and deposit insurance schemes, market sentiment, while remaining cautious, has already fueled the recovery of crude oil prices, so that the CAD could recover in the short term.

Technical analysis

Keeping track of forex market hours and trading opportunities.

It’s important for forex traders to know when the markets are open and when they can take advantage of trading opportunities.The forex market is open 24 hours a day, five days a week, with trading sessions in different time zones around the world.The most active trading sessions are during the overlap of the Asian, European, and North American sessions. Traders can use this information to plan their trading strategies and take advantage of market volatility during these times.

Analyzing market trends and making informed trading decisions.

In the fast-paced world of forex trading, it’s crucial to stay informed on market trends and make informed trading decisions. One way to do this is by analyzing technical indicators and economic data to identify potential trading opportunities. It’s also important to have a solid understanding of market fundamentals, such as supply and demand, geopolitical events, and central bank policies. By staying up-to-date on market news and trends, forex traders can make informed decisions and maximize their profits.Utilizing technical analysis tools to identify potential entry and exit points.

Technical analysis tools can be incredibly helpful in identifying potential entry and exit points in forex trading. These tools include chart patterns, trend lines, moving averages, and oscillators. By analyzing these indicators, traders can identify potential buying or selling opportunities and make informed decisions about when to enter or exit a trade. It’s important to note, however, that technical analysis should be used in conjunction with fundamental analysis to get a complete picture of market trends and trading opportunities.West Texas Crude (WTI) (XTIUSD)

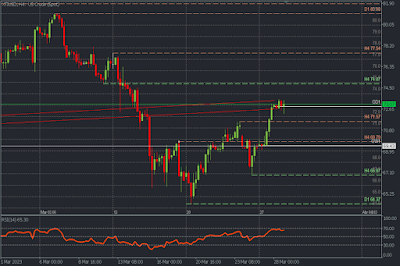

The benchmark in the US and Canada has started a new bullish sequence after breaking the resistance of 69.79. Currently, it is consolidating after opening the week with a bullish expansion that exceeds 73.00. The bullish continuation will look for the area of the broken support that now acts as resistance towards 76.00. However, we can expect a pullback towards the broken resistance at 71.57 and 70.00 more extended, as long as the quotes hold below 73.00.USDCAD

It has been trading within a bearish wedge pattern for two weeks now and is currently above the lower bound of it, which implies that bearish continuation will not only invalidate the bullish reversal scenario, but also extend selling towards 1.36. intraday and daily support at 1.3555, testing the macro uptrend. On the other hand, this pattern suggests the possibility that the pair will continue to strengthen in the medium term, a scenario that will be confirmed with the bullish rally towards the weekly open and the break of the upper limit of the pattern towards 1.38 in the short term.CADJPY

It caused a false break of the last relevant resistance at 96.32, so a second decisive break will start a change in trend, whose next buy objective is the round level 97.00 and 97.53, highlighting two sales zones around 96.64 and 97.23. This could trigger the pair's bears to pull back towards the last buy zone at 95.24, which is far from the last support of the downtrend at 94.07, the break of which will continue to extend the pair's downtrend.

.png)

0 Comments